A single compliance solution for crypto businesses

Crypto AML Scan automates AML / KYC procedures and reduces compliance costs

Check your wallet Help

Our 300+ customers and partners

+$100 000 000

60,000+

Volume of identified risk funds

Regulatory departments that adopt our AML procedures

Verified service providers

+$100 000 000

Volume of identified risk funds

Regulatory departments that adopt our AML procedures

60,000+

Verified service providers

Crypto AML Scan Services

We provide a full package of options for secure work with cryptocurrency

ISO certified

We are constantly improving our security measures to ensure reliability and protection. Learn more about our certifications

Read moreHow much is your peace of mind worth?

The first inspection is free of charge

From

$0.2 / for checking

Check it out

According to our statistics, every fourth wallet is suspicious.

By spending a couple of dollars to check, you can save yourself from losing several thousand

dollars.

Why Crypto AML Scan?

Personalised approach

- Crypto AML Scan offers a wide range of compliance solutions customised for each client.

- We are confident that we can meet your requirements, as we have helped 300+ cryptocurrency organisations of all sizes in 25 jurisdictions.

Integrated Compliance Platform

- We offer KYT/Wallet screening, KYC, AML and more for crypto businesses.

- Crypto AML Scan risk assessment is based on multiple data sources, providing the most reliable information in the industry.

- Our user-friendly services and solutions streamline company processes, eliminating the complexities associated with service provider compliance.

Customer support

We understand how important fast and friendly support is to our customers, that's why we're always here for you. 24/7 support.

It may take a little longer to respond at night

ContactOur team

Co-Founder

Alex Johnson

Blockchain Analyst

David Carter

Certified AML Specialist

Ethan Brooks

Head of Investigations

Liam Cooper

Popular questions

In addition, the verification result may contain various additional information about the address, such as cluster membership, actual balance and amount transferred.

If the required information is missing, the result of the test may be incomplete compared to the data described.

Note that for blockchains with limited validation, clustering and risk score percentages are not available. A risk score can only be provided for a counterparty if it belongs to a clustered entity.

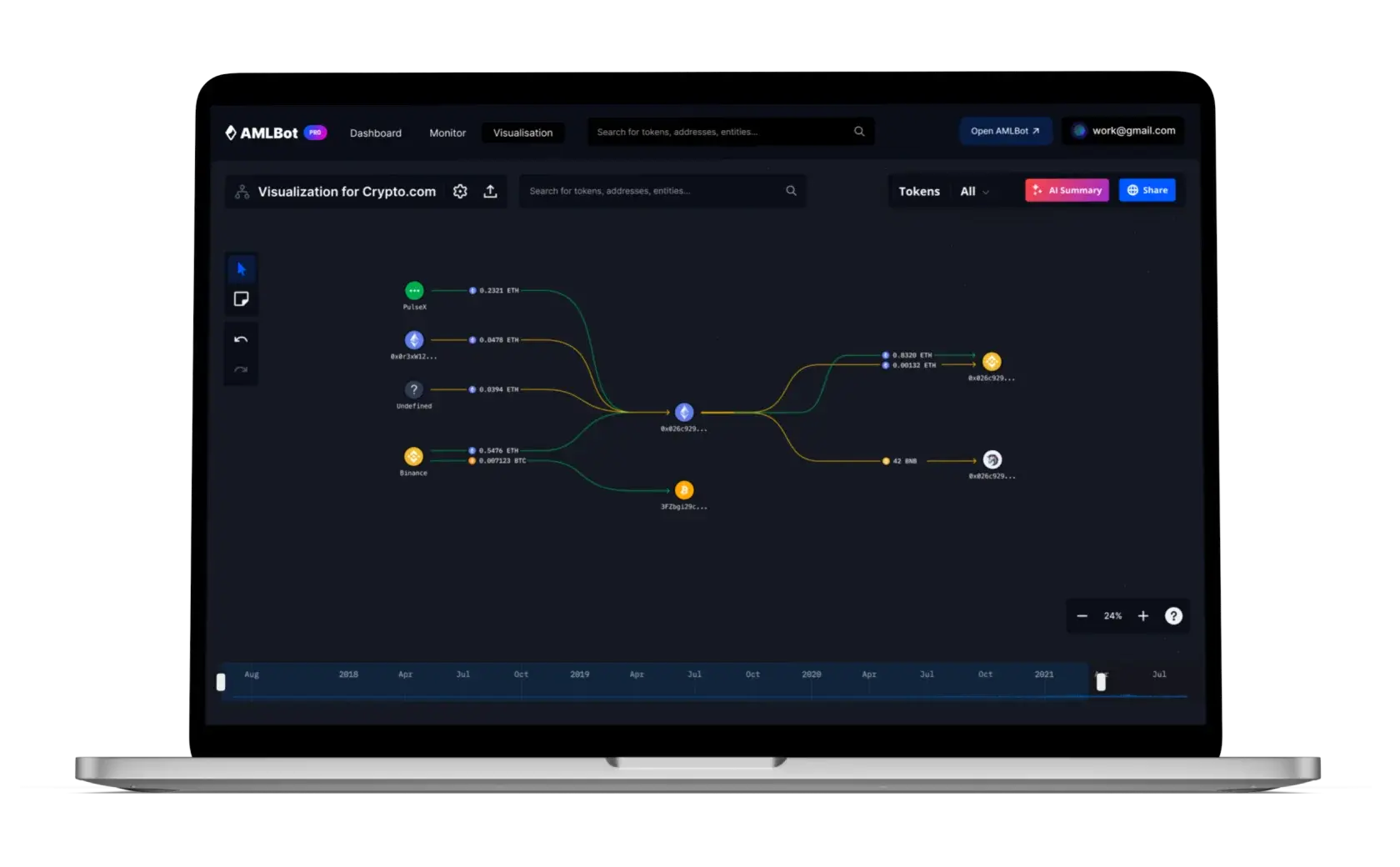

Crypto AML Scan finds links of a verified address to other addresses on the blockchain and to objects in different categories, each with a different conditional risk score, and calculates an overall risk score based on those links.

The severity of detected connections is taken into account when calculating the overall risk score. For example, in the case of connections to organisations' categories of "Mining" (0% risk) and "Darknet" (100% risk), the impact of Darknet as the riskier category will be higher, and mining will be given less weight in the risk assessment.

The AML check shows the connections of the address being checked with these entity categories as sources of risk with which the address has interacted and the percentage of funds transferred from/to these services.

Based on all sources of risk, an overall risk score is calculated to help the user make further decisions about assets.

The process of transaction verification is different from address verification, and the outcome depends on your side in the transaction. The overall risk assessment always depends on the counterparty.

To verify a transaction, you need to provide the TxID, the address of the recipient of this transaction and select your side in the transaction:

- Recipient (you received a deposit to your wallet) - the addresses from which the funds were received are checked. The sources of risk describe the services by which TX senders accumulated the transferred funds with a percentage breakdown.

- Sender (you withdrew funds from your wallet) - the address where the funds were received is checked. Risk Sources describes all connections of the recipient address with a percentage breakdown.

Thereby, the transaction verification checks the recipient's risks in receiving the funds and the sender's risks in sending the funds.

- 0-25% is pure wallet/transaction;

- 25-75% is an average risk level;

- more than 75% of such a wallet/transaction is considered risky.

It's also worth looking at the red sources of risk in the detailed analysis described at page

If the check shows that your assets have not been linked to illegal activity and the service has blocked you, you can submit a saved result to confirm the cleanliness of your assets.

• Up to 10 minutes if payment is made within 24 hours of invoice;

• Up to 25 minutes if payment is made 24 hours after the invoice is issued. In general, BTC, ETH, USDT and fiat are processed faster than other coins.

If you purchased checks with a limited expiry date, they will be debited from your account when they expire.

Our ISO 9001 certification emphasises our commitment to providing consistent quality and improving customer satisfaction. More importantly, our ISO 27001 certification demonstrates our commitment here.